Terms of the Credbull (CBL) Sale:

- IDO Type: Refundable (7 days refund period)

- Total Raise: $500,000

- PEG: TBD

- FDV: $30,000,000

- Listing: TBD

- Token price: $0.03

- Token Unlocks: 30% unlock at TGE, 6 month linear vesting

- Ticker: CBL

- Blockhain Network: Arbitrum

- SHO tokens network: Arbitrum

- Token Supply: 1,000,000,000

- Initial Market Cap: $3,200,000

- Initial Circulating Supply: 104,000,000

- Hard Cap: $5,500,000

- Mainnet Token Contract: 0xD6b3d81868770083307840F513A3491960b95cb6

What is Credbull (CBL)?

Credbull is an innovative platform focused on democratizing access to the private credit market, valued at over $2 trillion. It offers a unique onchain private credit fund that provides stable, high yields backed by real-world assets. Users can earn returns of up to 40%+ through its gamified app, inCredbull Earn, which aims to make investing more engaging and transparent.

The platform addresses the limitations of traditional investment options, which often underperform or carry excessive risk. Credbull’s offerings include fixed yield products with competitive annual percentage yields (APY)—8% for a 6-month lock-up and 10% for a 12-month lock-up. In Q4 2024, Credbull will introduce LiquidStone on the Plume network, promising 10% and 15% yield with daily redemption options.

With a team experienced in traditional finance and private credit, Credbull aims to provide reliable investment alternatives for individual investors, particularly in the Web3 space. The platform seeks to create a more inclusive financial ecosystem, allowing users to participate in stable returns while also supporting small and medium-sized enterprises (SMEs) through credit solutions.

Credbull’s Licensed Onchain Private Credit Fund 1

Credbull's Licensed Onchain Private Credit Fund represents a groundbreaking advancement in decentralized finance (DeFi), providing unparalleled transparency and accessibility to investors by bringing the entire fund onchain. Unlike traditional Real World Asset (RWA) investment opportunities that often lack transparency and remain offchain, Credbull's approach offers real-time visibility into its strategy, risk management, and performance. By issuing 'Claim Tokens' for self-custody, Credbull empowers decentralized governance, establishing new standards for transparency and accountability in the industry.

What makes Credbull (CBL) unique?

Credbull is a fully integrated and transparent DeFi Credit Platform in SME Real World Assets with a mission to advance a more inclusive and fair financial system.

Highlights of the Credbull OnChain Private Credit Fund 1

- Private Credit Access: A pivotal aspect of Credbull’s Onchain Private Credit Fund is offering investors the opportunity to tap into high-performing assets traditionally inaccessible to retail investors. Through established SME Originators, the fund provides access to private credit opportunities backed by tangible assets in sectors such as energy, agriculture, and infrastructure. This direct exposure to real-world assets not only diversifies investors' portfolios but also ensures a balanced capital preservation strategy. By bridging the gap between traditional finance and decentralized finance, Credbull empowers investors to participate in the growth of real-world businesses while benefiting from the transparency and accessibility of blockchain technology, thereby democratizing access to lucrative investment opportunities within the decentralized finance landscape.

- Transparency Across the Investment Life Cycle: Credbull ensures transparency throughout the investment process, from strategy formulation to risk management and performance evaluation, as well as capital allocation by Originator, product, and all SME transactions. By placing the entire fund onchain and providing 'Claim Tokens' for self-custody, investors have real-time visibility into the fund's operations, enhancing trust and confidence.

- Innovative Solution Addressing Market Challenges: Credbull's approach directly tackles critical challenges plaguing the market, including crypto volatility, suboptimal monetization of crypto platforms, and opacity in traditional asset management. By providing transparent and accessible investment opportunities, Credbull reshapes the landscape of both traditional finance (TradFi) and decentralized finance (DeFi).

- High Fixed Yields: A hallmark of Credbull’s Onchain Private Credit Fund is providing investors with stable returns in volatile markets. By structuring yields to offer predictability and consistency, the fund appeals to investors seeking reliable yield. This stability is achieved through targeted asset allocation and robust risk management strategies, ensuring that investors can count on steady yield regardless of market fluctuations. In today's low-interest-rate environment, Credbull's high fixed yields offer an attractive opportunity for income generation and portfolio diversification, underscoring the fund's commitment to delivering value and stability to investors within the decentralized finance landscape.

- Liquidity/Flexible Lock-ups: A distinguishing feature of Credbull’s Onchain Private Credit Fund is offering investors the freedom to tailor their investment timelines to align with their individual goals and preferences. This flexibility allows investors to choose lock-up periods that best suit their liquidity needs, whether they prefer short-term commitments or are willing to lock in their funds for longer durations. By accommodating varying investment horizons, Credbull enhances investor satisfaction and customization, empowering them to make informed decisions that align with their financial objectives. This feature not only enhances the fund's appeal to a broader range of investors but also contributes to its overall accessibility and inclusivity within the decentralized finance ecosystem.

- Credbull’s fund is licensed by the Securities Commission of The Bahamas pursuant to Section (1)(c) of the Investment Funds Act, 2019, No. 96-SFM002-001 issued on May 24th, 2024.

- Backed by GnosisVC, Outlier Ventures, HODL Ventures and others

- Incredibly engaged community size over 420K+ across all socials (165K on X), 147K monthly players on BullTap (Tap&Earn game), gaming arm of inCredbull Earn rewards program. Over 50K+ onchain users within 3 months of launch.

View inCredbull Earn video here:

What is Credbull (CBL) roadmap?

Q2 2024:

- Private Credit Fund - Secure the necessary licenses for the Private Credit Fund.

- Private Credit Fund (B2B Launch) - Launch the Private Credit Fund to institutional investors and accredited investors.

- Early Adopter inCredbull Vault - Open the Vault for early adopters to deposit funds and receive exclusive benefits and $CBL Token.

Q3 2024:

- inCredbull Earn Launch - Launch version 1 of the inCredbull Earn platform, allowing users to earn rewards through various activities.

- BullTap Launch - Launch the BullTap, Telegram game. Players take part in daily tapping and quests as part of the inCredbull Earn rewards program to earn points which translates into $CBL (Credbull) rewards. These users will be later introduced to the lending platform.

- Token Generation Event - Conduct the Token Generation Event (TGE) to distribute the native token to stakeholders.

Q4 2024:

- Product Launch - Launch of LiquidStone, 10% and 15% APY, $500M asset capacity, available on the Plume network

Q1 2025:

- Retail Platform Launch - Launch the retail platform, Credbull DeFi, allowing individual lenders to access the Private Credit Fund and other lending opportunities.

- inCredbull Earn Governance Launch - Implement token utility for fund governance and rewards.

- inCredbull Earn Launch (Full) - Launch the complete version of the inCredbull Earn platform, offering a wide range of earning opportunities and enhanced features.

- Launch of bespoke institutional products

Credbull (CBL) revenue streams

The private credit fund generates a gross yield of 20-22% APY, the upside is very healthy to sustain operations. We focus 80% of our efforts on institutional TVL which is a significant liquidity pipeline, sticky and growing, and 20% of our efforts on driving retail TVL.

What is Credbull (CBL) product dive?

Bespoke products targeting institutional TVL (80% of TVL contribution), and launch of retail DeFi product with same access to high yield products, with token top ups for enhanced yields (20% of TVL contribution). First $100M TVL will come from partnership with Plume Network, with roll-out of vaults deployed on other chains, including Nibiru chain and others to be announced.

Launch of LiquidStone product with Plume. Focus on treasury management solutions for L2s, DAOs that are looking to generate stable high yields in USDC lending. Credbull DeFi Permissionless will be retail-facing. Yields are topped up with tokens from $CBL, and also through partners such as Plume Network and others, creating overall products with 40%+ yields.

Additionally, in time, Credbull will launch two liquidity features with the activation of Credbull’s $CBL token:

- DeFi Composability: Lenders will be able collateralize their Claim Token for seamless borrowing

- P2P Liquidity & Marketplace: Lenders will be able to transfer their Claim Token in a peer-to-peer (P2P) marketplace at any time during the lock up period and to unlock their stables.

What is Credbull (CBL) marketing strategy?

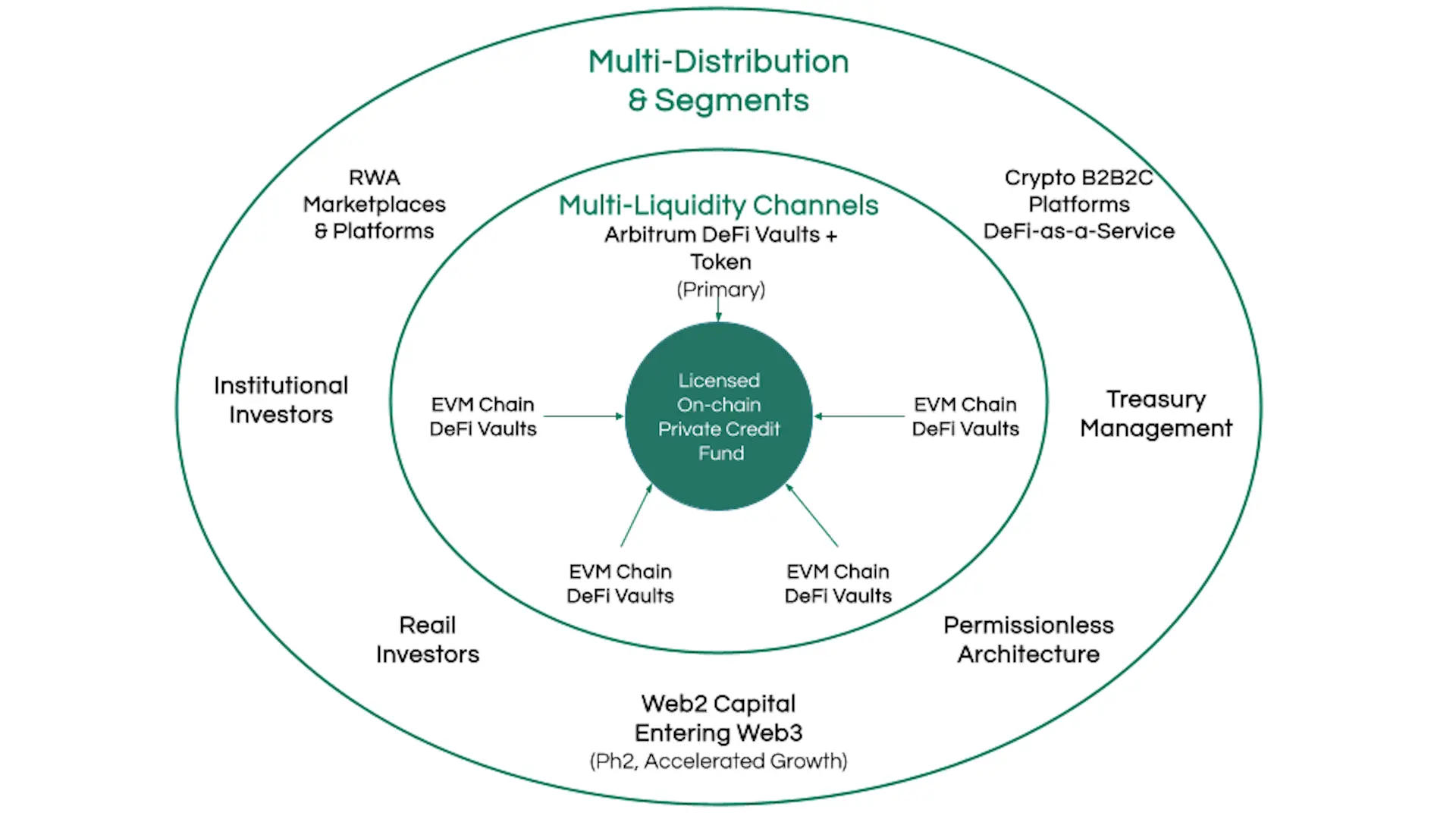

The Orbit Distribution Strategy is designed for go-to-market with high scalability, operating across multiple liquidity pools and segments. Its execution occurs in phases, with a prioritisation ratio of 80/20 Pareto principle to ensure focused efforts. The Pareto principle states that for many outcomes, roughly 80% of the consequences come from 20% of the causes (the “vital few”) - in this case, we focus on 20% of the client platforms/segments to unlock 80% of the liquidity/Total Value Locked (TVL).

Credbull's Licensed Onchain Private Credit Fund operates on Polygon, migrating to Plume Network in Q4, leveraging Centrifuge’s onchain asset management infrastructure, while its DeFi lending vaults remain chain-agnostic, accessing diverse liquidity sources. Initially deployed on Arbitrum, the vault gradually expands to accommodate liquidity across different destinations over time.

Distribution channels and segments leverage Credbull structured high fixed yield products on preferred EVM chains, with a primary focus on RWA Marketplaces and B2B2C Platforms. Examples of B2B2C Platforms include crypto custodians, liquidity providers, DApps, CEX/DEX, stablecoin lending platforms, crypto wallet platforms etc.

Additional liquidity sources include project treasuries, institutional investors, and crypto natives seeking diversified, high fixed yields.

In phase 2, Credbull’s open architecture vaults democratizes access to private credit globally. 3rd party Web3 projects can deploy their own Credbull vaults in a permissionless manner

- Build offering by regional target, e.g. Brazil, LatAm, Africa

- Access to same products and terms - TVL to Credbull

- Receive distribution fee, incentives and customizable features

- Expand GTM distribution globally

A compelling long-term prospect awaits in drawing new Web 2 capital into Web 3. Within the crypto market, liquidity appears akin to a red pond, constantly shifting between crypto protocols and projects driven by ever-changing narratives. Yet, there's been a noticeable absence of net new capital inflow since the last cycle. Our strategic vision involves enticing fresh Web 2 capital into the realms of Web 3 through our DeFi fund. Presently, Web 2 lacks offerings of uncorrelated, high fixed yields with low minimum investment thresholds, presenting vast potential for adeptly executed go-to-market strategies.

The Orbit strategy spans multiple distribution channels and segments, driving widespread impact and fostering sustained growth.

inCredbull Earn

inCredbull Earn is an innovative, gamified “engage and earn” rewards platform designed to foster community growth, user engagement and rewards, and drive Credbull's DeFi ecosystem growth. By leveraging a quest-based approach and offering exciting rewards in Credbull’s native $CBL Token, the platform aims to attract and retain users while encouraging active participation in various campaigns and activities.

Bull Tap (Bull_Tap_Bot) is the viral tap and earn game on Telegram launched by Credbull that feeds players into inCredbull Earn.

inCredbull Earn is a Credbull points program with exposure to over 420K+ followers in Credbull’s community, promoted by many KOLs, and new participants are being brought in through BullTap (Tap&Earn Game on Telegram, launched by Credbull with over 147K+ monthly active users), and the soon to be launched game, Bull Run.

It is already a very active points program with players completing many quests in order to rank high in the leaderboard and earn their Credbull $CBL tokens. Players are called “Bulls”, who compete in a “hunger games style” points challenge, doing everything from lending into the fund, buying and staking $CBL, social quests and referring people into inCredbull Earn, creating a viral flywheel effect.

How It Works

As users engage with diverse quests and campaigns, they accrue points based on their level of involvement and performance. Each activity carries a designated point value, rewarding users for their time, effort, and commitment. Through task completion, milestone achievement, and demonstration of skills and knowledge, users accumulate points, advancing within the platform. These points are then tabulated and tiered to yield a distinctive multiplier reward in Credbull’s $CBL Token. Top 25% gets 4x points multiplier, next 25% gets 2x, and 50% gets 1x. Inactive members are kicked out of the program to keep every player on their toes! This has created a viral army of players who are competitive to engage with Credbull and rank up.

What technologies Credbull (CBL) created and used?

- Credbull DeFi Vaults: smart contracts adhering to the ERC-4626 Tokenized Vault Standard based on OpenZeppelin’s implementation. When Users deposit USDC they are issued “Claim Tokens”, an ERC-20 token representing proportionate ownership in the Vault. At maturity, the Vault determines the total returns for each User, factoring in their initial deposit and their share of the yield.

- Onchain Private Credit Fund: smart contract, likewise based on the ERC-4626 Vault Standard. Receives deposits from the Credbull DeFi Vaults, oversees the allocation of the fund and manages distributions back to the DeFi vaults. With this innovative setup, our platform caters to different segments and license structures: B2B, B2C, and B2B2C.

- DeFi as a Service (DaaS): our API-driven approach allows partner platforms to easily integrate and use our services. Services are built using Nestjs, “a progressive Node.js framework for building efficient, reliable and scalable server-side applications”.

- inCredbull Earn Platform: our gamified community engagement platform integrated with Zeal.io. Creates and manages investment themed campaigns. Users earn token rewards based on their activity and tiered rankings.

- Wallets and Accounts: Users can either connect their existing wallets or opt for a Circle Programmable Wallet from us. Circle wallets offer a user-friendly interface and are fortified with advanced security protocols, including multi-party computation (MPC) technology, for safe and secure transactions.

- Fiat On/Off-Ramp: our contracts and services integrate with Circle Mint to facilitate efficient and secure conversions between stablecoins and fiat currency.

- Real World Asset (RWA) Oracle: Onchain record of transactions and data from our off-chain Lending Management System and Originators. Designed using Blockchain Oracles.

Who is Credbull (CBL) team?

- Jason Dehni - Cofounder & Group CEO; 25+ years in international banking, SME lending, asset management, insurance, risk and crypto

- Ian Lucas - Chief Technology Officer; 20+ years as Chief Engineer & IT Director at leading Web3 and Web2 financial organizations

- Tavia Wong - Chief Marketing & Partnership Officer; 12+ years as Chief Executives in B2B SaaS, blockchain, marketing, DeFi, partnerships and crypto

- Pedro Viegas - Chief Product Officer; 15+ years in software engineering and product development, co-founder of a development agency

- Lucas Koch - Head of Product inCredbull Earn; 10+ years of experience in product design, development and scaling in both Web3 and Web2

- Ishani Kaur - Director of Risk Management; Seasoned Risk Executive in SME lending, trade finance, offshore entities and capital allocation

- Jonathan Lodge - Senior Software Engineer

- Nawar Hisso - Senior Software Engineer

- Chai Somsri - Senior Software Engineer

- Krishna Kumar - Software Engineer

Who are the partners of Credbull (CBL)?

- Main investors: Gnosis VC, Outlier Ventures, HODL

- Partners: Plume network, Arbitrum foundation, Centrifuge, Bitlayer, etc.

- Advisors: Marcello Mari, Sterling Witzke, Coach K Crypto