Terms of the Trakx (TRKX) Sale:

- IDO Type: Refundable (3 days refund period)

- Raise at DAO Maker: $200,000

- PEG: TBC

- FDV: $25,000,000

- Listing: October 2024

- Token price: $0.025

- Token Unlocks: 20% unlock at TGE, 1 month cliff, 6 month linear vesting

- Ticker: TRKX

- Blockhain Network: Polygon

- Token Supply: 1,000,000,000

- Initial Market Cap: $300,000

- Initial Circulating Supply: 12,000,000

- Hard Cap: $1,000,000

- Mainnet Token Contract: 0x61bf130d973D59c69d3227f1668d534d83119860

What is Trakx (TRKX)?

Trakx is a regulated platform for crypto-index trading, offering thematic Crypto Tradable Indices (CTIs) and strategies. Through its trading platform, Trakx offers an array of thematic Crypto Tradable Indices (CTIs), simple access products, smart investing strategies, risk profiled strategies and staked indices. Trakx CTIs are designed for institutional and retail investors.

What are the advantages of investing in CTIs?

- Diversification: Investing in CTIs spreads risk across multiple cryptocurrencies, reducing volatility and cushioning against market downturns.

- Exposure to a range of cryptos: CTIs offer exposure to various digital assets, including established and emerging cryptocurrencies, allowing investors to tap into the overall growth of the market.

- Convenience: CTIs simplify the investment process by delegating portfolio management to professionals, freeing investors from extensive research and monitoring. This streamlined approach offers a hassle-free investment experience.

- Permanent liquidity: Through fixed and transparent rules, Trakx selects the most liquid and relevant assets in each category and avoids scams, minefields, liquidity traps

- Sophisticated & transparent rule-based index strategies: Publication of CTI token holdings, their weights and NAV.

What makes Trakx (TRKX) unique?

- Experienced Team: At Trakx, our team brings together seasoned experts with diverse backgrounds in institutional finance, fintech, and crypto markets. This blend of skills ensures we have a deep understanding of the financial landscape.

- Regulatory Compliance: We're proud to be registered as a Virtual Asset Service Provider (VASP) with French regulators AMF (Autorité des Marchés Financiers) and ACPR (Autorité de Contrôle Prudentiel et de Résolution). This demonstrates our commitment to meeting regulatory standards and building trust in the industry.

- Proprietary Technology: We're all about leveraging technology to drive innovation. With our tech-first approach and proprietary technology, we're able to deliver cutting-edge solutions in crypto asset indices, making things efficient, agile, and adaptable.

- Risk Management: We manage risk carefully and responsibly. By minimizing exposure to counterparty risk and avoiding activities like lending, derivatives, or leverage, we create a safe and sustainable investment environment.

- Safe Custody: Your assets are in good hands with us. We prioritize their safety by storing them securely with leading custodians (Fireblocks and Coinbase Custody), giving investors peace of mind about the security of their investments.

- End-to-End Control: From designing our crypto indices to executing them, we maintain full control over the entire process. This ensures that we stay aligned with our strategic goals and maintain high-quality standards every step of the way.

What is Trakx (TRKX) roadmap?

2024

- Prepare the transition to MiCA - Strategize and implement measures to ensure compliance with the Markets in Crypto-Assets (MiCA) regulations for seamless transition.

- Launch of more sophisticated products for sophisticated traders.

- Push on bespoke solutions - deployment of tailor-made solutions to address specific client requirements.

- Develop tech-as-a-service offering - Create a comprehensive technology-as-a-service offering to provide clients with customizable white label tech solutions.

- Expand geographic footprint outside Europe - Explore opportunities for market expansion and establish presence in new geographical regions beyond Europe.

- Fine-tuning of the data mining and trading bots - Continuously optimize and refine algorithms and parameters of data mining and trading bots for improved performance and efficiency.

- Mobile app - Develop and launch a mobile application to extend accessibility and convenience for users accessing the platform on mobile devices.

- Dashboard for influencers - Develop a specialized dashboard tailored for influencers. Yield staking CTIs (similar to Staked Matic) - Implement yield staking mechanisms for CTIs akin to the Staked Matic model, to encourage token holder engagement.

- Allow listing some products only to selected user groups - Enable the feature to restrict product listings to specific user groups, enhancing targeted marketing and exclusivity.

- USDc Earn CTI - Develop a new CTI that generates yields from t-bills.

- Ability to let customers stake POS assets - Introduce the capability for customers to stake Proof-of-Stake (POS) assets.

- Create a notification center on the WebApp - Implement a centralized notification system within the WebApp to keep users informed about relevant updates and events.

- Add translations to the website and app - Expand accessibility by incorporating multilingual support for the website and application, catering to diverse user demographics.

- Obtain SOC2 Type 2 or ISO27001 Certification - Pursue industry-standard certifications to ensure compliance with security and data protection protocols, fostering trust and credibility.

- Build a mobile trading app - Develop a dedicated mobile application for trading activities, offering convenience and flexibility to retail users.

- Use Fireblocks as (Custodial) hot wallet - Integrate Fireblocks as a custodial hot wallet solution to enhance the security and management of digital assets.

- Offer DCA strategy (small regular investments) - Implement Dollar-Cost Averaging (DCA) strategy functionality to enable users to invest small amounts regularly, promoting long-term investment habits.

- Add some gamification principles in the Exchange - Incorporate gamification elements into the exchange platform to enhance user engagement and retention through interactive features.

2025

- Allow redemption in kind - Explore the implementation of redemption options in kind, providing users with alternative methods to redeem assets.

- Use ZK Proofs for Proof of Fundings - Investigate the utilization of Zero-Knowledge Proofs (ZK Proofs) for verifying Proof of Fundings, enhancing privacy and security.

- Conversational UI - Develop a conversational user interface (UI) to streamline user interactions and enhance user experience through natural language processing capabilities.

- Yield offer on USDc / see USDc earn CTI- Explore opportunities to offer yield incentives on USD Coin (USDC) or leverage the Yield Treasury CTIs to optimize yield generation strategies.

- On Ramp solution - Implement an on-ramp solution to simplify the process of converting fiat currency to cryptocurrency, facilitating user onboarding and adoption.

- Fireblock Non Custodial Wallet - Develop a non-custodial wallet solution leveraging Fireblocks technology to provide users with enhanced control over their digital assets.

Trakx (TRKX) revenue streams

- Trading Fees (Maker/Taker): Maker Fees: Charged to users who provide liquidity to the market by placing limit orders that don't get immediately filled. Taker Fees: Charged to users who take liquidity from the market by placing market orders or executing against existing orders.

- Management Fees: Charged based on the complexity of the product. Ranges from 1% to 2% annually, based on the product's structuring complexity. Management fees provide a more stable and predictable income stream compared to trading fees. They are not directly tied to market volatility, providing a balance in revenue generation.

- SaaS Fees for White-Label Solutions: We provide white-label solutions to other entities such as exchanges, brokers, and neo-banks and charge Software as a Service (SaaS) fees for the use of our technology and infrastructure.

How does Trakx (TRKX) work?

- THEMATIC INDICES

- Trakx Bitcoin/Ether (50/50): This index replicates the performance of Bitcoin and Ether, the top two digital assets representing altogether over 50% of the total crypto market capitalisation of all crypto-assets. The value proposition resides in the complementarity of the two assets:store-of-value and blockchain adoption.

- Trakx Top 10 Crypto: This index replicates the performance of the 10 leading digital assets, representing altogether over 85% of the total Crypto market capitalisation. The constituents are weighted according to their market capitalisations with a cap. This index essentially captures the growth of the asset class.

- Trakx Centralised Exchanges: This index replicates the largest Centralised Digital Asset Exchanges ("CEX") tokens. A CEX is an execution platform managed by a single operator, which gives access to various financial services. Most of the crypto volumes go through CEX, this index essentially captures the growing adoption of cryptos.

- Trakx Top 10 DeFi: This index replicates the 10 largest decentralised finance protocols tokens. DeFi protocols provide a digital alternative to traditional financial services (payments, trading, insurance),accessible to anyone with an internet connection. This index essentially captures the explosive adoption of blockchain-based finance.

- Trakx Decentralised Exchanges: This index replicates the performance of the largest Decentralised digital asset Exchanges ("DEX") tokens. A DEX is a decentralised platform enabling the trading of digital assets in a peer-to-peer manner. This index essentially captures the rapid growth of the trading activity onto the blockchain.

- Trakx Lending: This index replicates the performance of the largest lending/borrowing protocols tokens. Lending platforms enable the lending of assets in the crypto sphere. This index essentially captures the rapid growth of the lending activity notably driven by high interest rates offered compared to those in traditional finance.

- Trakx Top 10 Proof-of-Stake: This index replicates the performance of the 10 leading Proof-of-Stake (PoS) digital assets. PoS was designed as a sustainable and scalable consensus algorithm to tackle Proof-of-Work inherent issues (very energy-intensive). This index essentially captures ESG compliant growth of the ecosystem.

- Trakx Top Blockchains: This index replicates the performance of the tokens issued by the 10 largest smart contract platforms. to the broader crypto market beyond bitcoin. Smart contract platforms nurture a rich environment for innovation that leverage network effects, decentralisation.

- Trakx NFT Metaverse: This index replicates the leading Metaverse and Non-Fungible Tokens, currently disrupting the world of gaming, entertainment, and art. Both universes are intertwined: metaverse protocols create virtual social spaces where users may buy virtual lands, avatars, or other collectibles in the form of NFTs.

- Trakx Interoperability: This index replicates the leading Interoperability tokens. Interoperability enables blockchains to share their data and interoperate with one another, a cornerstone feature of a multi-chain world. This index essentially captures the growth of web3 architecture so dependent on interoperability protocols.

- Trakx ESG: This index replicates the price of best-rated crypto-assets in terms of Environment, Social and Governance. Trakx relies on Green Crypto Research (GCR) to score the largest assets in all three areas. The constituents are weighted according to their market capitalisations with a cap of 25%, to enhance diversification.

- Trakx DePIN: This index replicates the performance of Decentralized Physical Infrastructure Networks (DePIN) cryptocurrencies. DePINs use blockchains and token rewards to develop physical infrastructure in the real world across fields such as transport, energy, and wireless connectivity.

- Trakx Real World Assets: This index replicates the performance of real world assets (RWAs) cryptocurrencies. The constituents are selected based on their market capitalization, liquidity and custody, and rebalanced on a monthly basis with an equal weighting .

- Trakx Artificial Intelligence: This index replicates the performance of artificial intelligence (AI) cryptocurrencies selected based on their market capitalization, liquidity and custody, and are rebalanced on a monthly basis with an equal weighting.

- Trakx Gaming: This index is composed of the 10 top Gaming crypto-currencies by market capitalisations, equally weighted.

- SMART INVESTING (ruled based)

- Trakx Bitcoin Control 15: This index gives exposure to bitcoin with a lower targeted level of volatility than bitcoin itself. The volatility control mechanism is set to maintain the volatility of the index at around 15%.

- Trakx Digital Inflation Hedge: This index is designed to hedge against inflation through digital assets. Trakx has built an equally-weighted basket composed of Pax Gold (fully backed by physical gold) and a dynamic exposure to Bitcoin. Both gold and bitcoin are considered as safe havens at times of market uncertainty

- Trakx Recovery: This index replicates the performance of a basket of tokens that have undergone notable price drops but have robust on-chain financials.

- Trakx Bitcoin Momentum: This index exploits the trends in the crypto market to create a risk-managed exposure product. It trades only long bitcoin positions between 0% and 100%, identifying trend breakouts and applying filters to mitigate weak trading signals.

- RISK-PROFILED

- Trakx Conservative: This index is designed to replicate a conservative risk profile crypto basket, heavily weighted toward safer crypto assets with the stablecoin (USDc) and top 2 crypto-assets (Bitcoin and Ethereum) jointly counting for more than 75% of the total exposure.

- Trakx Balanced: This index offers a good balance between safer assets represented by the stablecoin (USDc) and the top 2 crypto-assets (Bitcoin and Ethereum), jointly counting for more than 50% of the total exposure, and less than 50% to other crypto assets through the Trakx Top Blockchains CTI, that are further diversified within the largest smart contracts crypto assets.

- Trakx Growth: This index takes on higher crypto risks than conservative or balanced crypto baskets with the aim of generating higher returns. The exposure is mainly driven by Trakx Top Blockchains CTI, counting for 75% of the total allocation, thus providing potential upside exposure to the broader crypto market beyond bitcoin.

- STAKED / EARN

- Staked matic: This instrument is designed to replicate the performance of Matic in addition to the yield resulting from the staking rewards.

- USDc Earn (to be released): This instrument is designed to allow users to seamlessly earn US Treasury Bills (T-Bills) like returns, while the assets are securely managed through OpenTrade.

The product was developed in partnership with OpenTrade.

What is Trakx (TRKX) marketing strategy?

SOCIAL MEDIA MARKETING

Social Media Engagement: We maintain an active presence on X, Telegram, and LinkedIn, regularly posting updates and engaging with our community. Our social media marketing efforts have seen remarkable growth over the past few months, with our community expanding from 5,000 to more than 15,000 members. In the coming three months, we aim to expand this community to over 30,000 members.

COMMUNITY GROWTH

- Community growth is a cornerstone of our strategy, and we've made significant progress in this area, leveraging various initiatives to attract and retain members. Through our concerted efforts, we've seen our community flourish, bolstered by compelling content and strategic partnerships.

- Gamification: In preparation of the token sale, we are using gamification tactics, including contests, giveaways, and airdrops in order to drive user participation and excitement within our community.

- Content Creation: We invest in creating valuable content that resonates with our audience, providing them with insights, updates, and educational resources to enhance their understanding of our platform and the crypto landscape. Those articles can be found on our blog and on external websites through guestposting (to build up our SEO authority).

- Growth Quests Programs (Zealy, Galxe): We've implemented Growth Quests Programs like Zealy and Galxe, which incentivize community members to participate in activities that contribute to our growth objectives.

- Events (AMAs, Twitter Spaces): We regularly host events such as Ask Me Anything (AMAs) sessions and Twitter Spaces discussions, providing opportunities for our community to interact directly with our team.

PR & KOL CAMPAIGNS

Our PR, and Key Opinion Leader (KOL) campaigns helped us to build our brand visibility and credibility within the industry.

- Press Release Creation and Distribution: We utilize press releases to communicate important announcements and milestones, ensuring that our news reaches relevant media outlets and publications.

- Influencer Outreach and Management: Partnering with influential figures in the crypto space through Markchain and KOLhq (marketing agencies) has enabled us to collaborate with tier 1 influencers.

- KOL campaign managed by Lunar Strategy to prepare the IDO.

PARTNERSHIPS

Collaborations and partnerships are integral to our growth strategy, allowing us to tap into new markets, access diverse audiences, and drive mutual value creation. Through strategic alliances and cross-marketing campaigns, we are expanding our reach and solidifying our position within the ecosystem. Example of our marketing partnerships:

- Global Football Alliance: Collaborating with football clubs for co-marketing efforts to reach a wider audience and promote Trakx within the sports community.

Develop Cross-Marketing Campaigns: By joining forces with complementary projects and brands (eg: Openmarket, Market Securities, Calci Patrimoine…), we create cross-marketing campaigns that leverage each other's audiences, maximizing exposure and driving mutual growth.

What technologies Trakx (TRKX) created and used?

- Backend services allowing to monitor and perform collateralisation of the CTIs (C#, Postgres, Redis, Fireblocks Api integration, Exchanges API integrations)

- Tools to allow privileged users to manage their CTIs (via API implemented in C# Asp.Net Core, or the corresponding frontend in Blazor, MySql database)

- Integration with Auth0 across the whole client-facing system, interaction with KYC provider Shufti, interaction with DocuSign for onboarding with EAS, fully compliant with French regulator requirements (C#, Postgres, Redis, Rabbit MQ)

- Tools to allow digesting incoming market data in real-time, and persisting them for the long term (integration with Kaiko Streams, AWS Bucket for large data dumps, integration with Coingecko Api andCryptocompare API), perform outlier price detection - C#

- Calculation of CTI prices and publication through web sockets (Live) and historical (Rest) - C# AspNet core

- Infrastructure as code to help automate the provisioning of AWS services required to run the ecosystem

- Generic frameworks in C# .Net aimed at accelerating the development of new microservices

- A dedicated website allowing users to invest in the token private sale rounds (frontend React, backend C# Asp.Net Core)

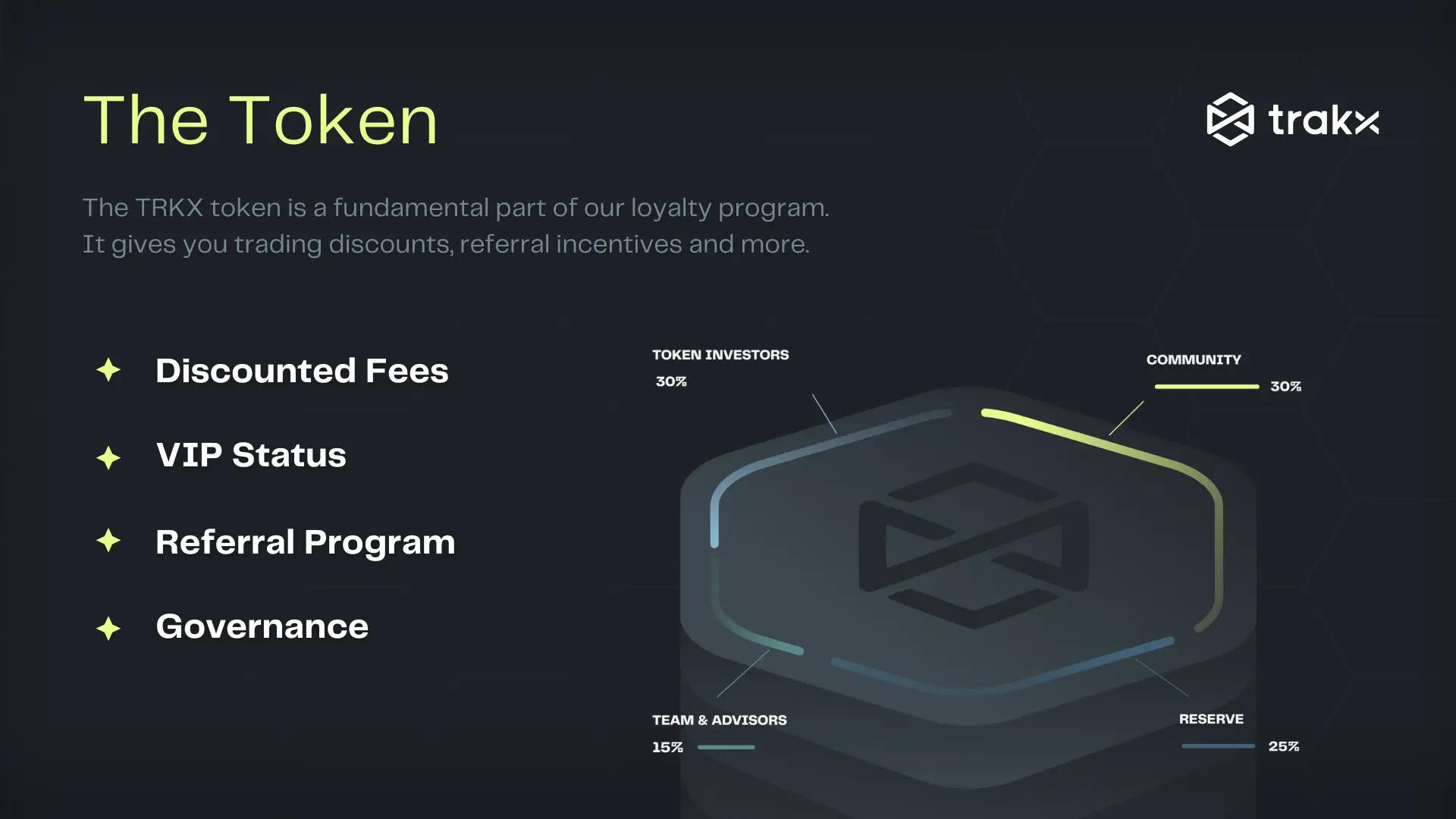

What are Trakx (TRKX) token utilities?

The Trakx token, TRKX, is a key tool to grow the Trakx ecosystem. It will provide its users with access to a wide range of advantages and benefits, including:

- Staking

- Buyback and burn programs: part of the revenues derived from the retail trading business will be used to discretionarily buyback the TRKX tokens

- Discount programs: on trading fees (on the platform) and management fees (on the products)

- Referral programs booster: extra rewards, depending upon the amount of TRKX tokens staked

- Yield booster: on

- Grant programs: active community members will receive grants in TRKX tokens in exchange for specific actions & services (e.g. deposits and/or CTI purchases or trading competition...)

- Governance: our community will get the opportunity to play an important role in certain decisions, such as grant programs (CTI selection, rebalancing...)

- Higher API trading rate

- Priority access to new products (ie. alpha and bespoke products) & dedicated services (white glove, managed accounts...)

What are the Trakx (TRKX) token metrics?

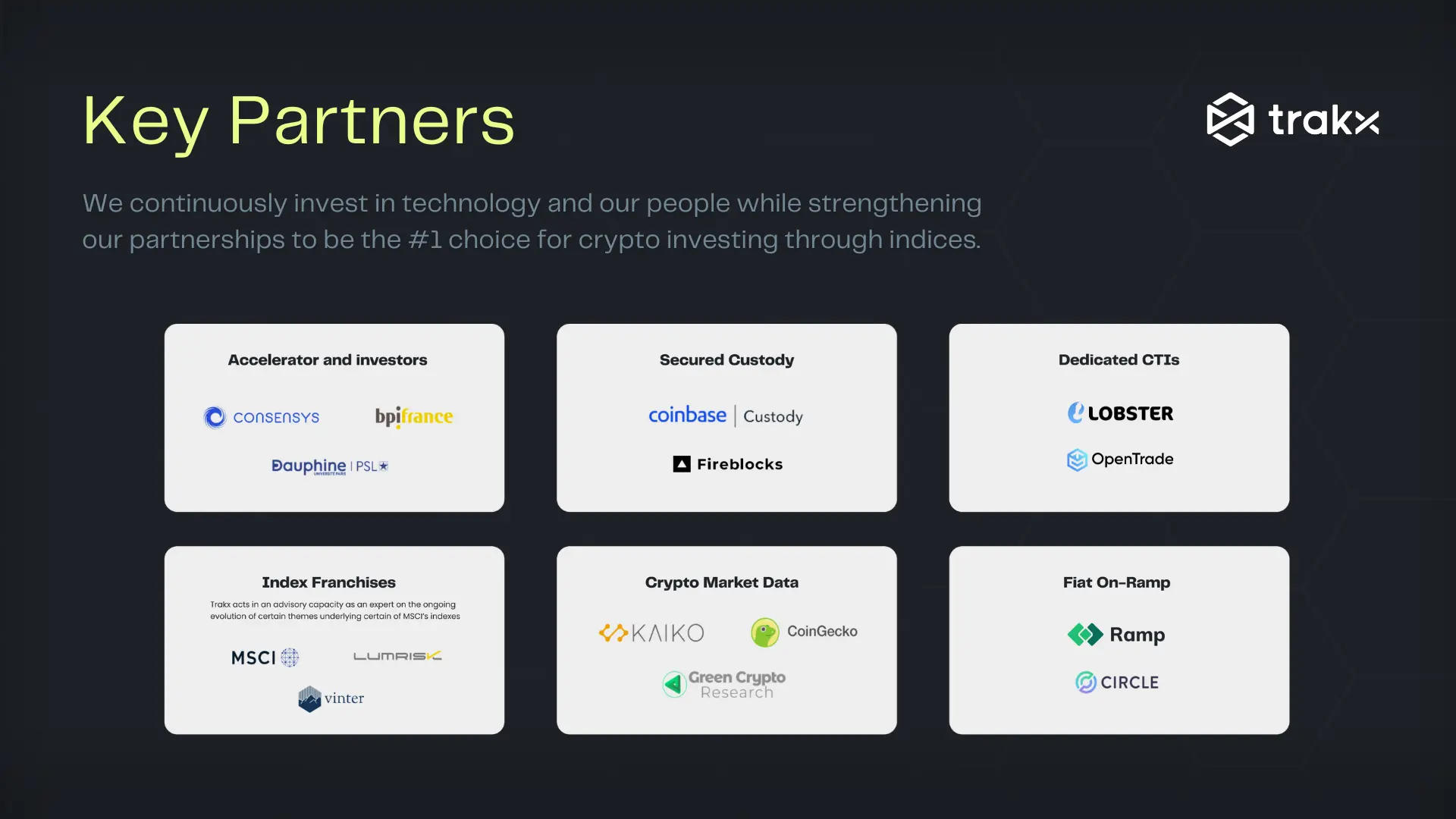

Who are the partners of Trakx (TRKX)?